Opportunity

Is your investment goal is to buy low and sell high? Highly successful investors are always the “contrary” investors; they are busy buying when everyone else is selling or scared, and conversely they are the ones selling when everyone’s buying! In many countries, real estate has sky-rocketed. Is it time to lock in profits and move to areas where values have been hit hard? Is it time for you to diversify?

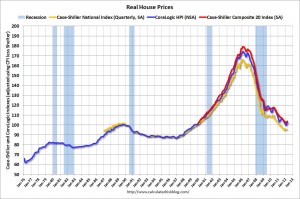

No doubt by now you’ve read about how US property values have fallen dramatically in the past few years. In a few states such as California, Nevada, Arizona, Michgan and Florida, property values have plunged as much as 50%-60% and more. We have some of them listed in our available property section along with price history. There are now many signs of stabilization or what we call the “bottoming out” process. You can see a lot of this supporting data in the blog section of this website.

Have you ever thought to yourself… Can a foreigner buy USA Real Estate? How would I go about finding some bargain or foreclosed houses that I read about? How can a foreigner manage the property in the USA? How would I get a house rented out for cash-flow while I hold it for long-term capital appreciation? And how would I manage repairs? What about USA government regulations?

Enter American Full House, LLC. Based in Texas and founded by an Indian ex-pat from Mumbai (Bombay), American Full House provides you with a complete real estate investment and management solution even though you’re far away. Regardless of whether your investment funds originate in India or any other foreign country, we will confidentially and efficiently help you find the right property investment. Please read more about us to understand why you can be confident your funds will be in safe hands. We will set up the right investment structure to protect and safeguard your property holdings here in the USA.

While no one can predict the future with certainty, given how much values have dropped since 2008, we feel that the downside risk is quite low while the capital appreciation potential over the next several years is rather high. We encourage our clients to think medium to long term; to plan on holding property at least 4-5 years for substantial gains. During this time, you can likely expect a cash flow, normally about 6-8% annually, after all fixed operating expenses.

Video: Successful Hedge Fund Manager Aaron Hedelheit Talks To CNBC About Investing in Foreclosed Homes

Diversify your investments. Invest in foreclosed/distressed American real estate at bargain prices. The opportunity to “buy low” has never been better. It is an interesting time in the US right now and there are many reasons to take advantage of this uinque time:

- The US economy has undergone a substantial recession.

- US banks are not in the real estate business but due to the state of the US economy at this time they are being forced to repossess properties on which they made bad loans. These foreclosures have had an effect of depressing property values across the board.

- Banks and other sellers will clear these properties off their books at discounted prices for investors who have liquid funds to buy them outright.

- After a long period of liberal lending in the US, real estate loans are very hard to come by now. Working Americans now have to go through a very tedious process to get a mortgage/real estate loan. As a result there are many more sellers than buyers at this time, thus creating a great investment opportunities for buyers.

- People who have been displaced from their homes or simply cannot qualify for a mortgage to buy one, still need to live somewhere! As a result, rents across the US are steadily increasing… creating an ideal cash-flow situation for investors with liquid funds to invest!

- There is significant opportunity for a group that has liquid funds to invest during this low point in the US economy. Good profits were made by people who had the funds to invest during the last real estate bust in late 1980’s.

- In countries like India, real estate values have gone through the roof… Isn’t it smart to lock in profits and move funds in to a market is on the low end? In these this turbulent times, diversifying your country risk, asset risk, and currency risk is prudent.

- For smaller investors in a country like India, is is not even possible to invest in real estate without a large amount of money.

- As the US economy continues to stabilize, substantial capital gains can be realized as real estate values and transaction rates return to more normal levels in the years ahead.

Take action now! As you can see on our website, there are very attractive turnkey properties available for the smart investor. Contact us today to get all your questions answered.