Global Uncertainty: Is this a good time to buy USA Real Estate?

Often, we are asked by potential investors: Is this a good time to buy property in the USA?… When will the recovery happen?.. And what about the US Dollar?… Isn’t it just better to invest at home?

Here I attempt to answer these commonly asked questions…

I actually traded for a living for a few years (for myself, not a job). I’ve always loved reading about economics, especially macro – the big picture. It became clear to me back in 2002/2003 that we were headed for a big global problem. There were a couple of economic blogs I followed that pointed out the crisis that bank derivatives would pose once the dam broke. It was likened to a tsunami coming back to hit the economy once the earthquake hit! I spent several months doing more diligent research and came to this same conclusion. After trading commodities (which I believe are in a cyclical bull run) until 2007, I slowly started shorting banks/brokers, mortgage companies, real estate outfits, and financial insurance firms. As you can imagine, I did very well as some of my short positions included New Century Financial, Bear Stearns, etc. After doing well for 3 years, I went backwards for about 4 months before deciding to hang it up. Why? For one simple reason. Government manipulation of the markets became too rampant and market forces were no longer determining outcomes. Unfortunately this has now spread to become a Global phenomenon, including in Europe and China, and will lead to some bad outcomes. Personally, I believe this compounds the problem and stretches out the painful cyclical pullback that is necessary. I believe the market is most efficient at weeding out the weak. My favorite saying is “Government: If you think the problems we create are bad, just wait until you see our solutions.” This is so true of the US and Europe right now.

Back in 2007, I was advising people to exit the stock markets and cash out. So having seen the crash coming and profited from it, I am now saying that it is actually a pretty good time to be buying houses in the USA! Read on to find out why…

Globally, we are going to be in a period of uncertainty that I believe will last a few years and not clear up any time soon. I would not wait for that. Many people (including our clients) are actually opting to stay out of stock markets completely. It’s a gift that stock markets have bounced back to good levels! Our clients generally feel that real estate provides a better, more secure, option at this time. I’ve always felt for Indians, the U.S. should be considered a secondary investment to diversify asset class, country, and currency risk. It’s prudent to move funds from real estate investments in India that have risen to very high levels, capturing profits, into select US markets that has fallen substantially.

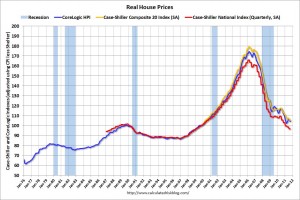

It is my belief, having carefully watched the financial and real estate sectors very carefully for the past decade, that the US quite near or at the bottom in the markets we are active in; Southern California, Las Vegas, South Florida, and Atlanta. Generally we are buying real estate that has fallen 50-60%. It is my opinion that given historical home prices and price to rent ratios that we fall no more than 5-10% from these levels. Even this would be easily made up with the rental incomes generated. Here is a link to this data with graphs going back to 1976. There was another good piece in the Wall Street Journal talking about why it is a good time to buy now (link).

Regarding the currency (US$), I think you all will actually be surprised for the next few years as it will keep strengthening. Europe is in far worse economic shape than the US. I believed from the beginning that the Euro was doomed to fail. How can you have a single monetary unit without fiscal union? It makes no sense. So unless countries like Italy, Spain, and even Germany are willing to give up sovereignty, I see the Euro falling apart very quickly. If you agree with my opinions, there is no other safe haven than the US Dollar. Look at U.S. treasuries, still at record low yields! While this is going on, our private companies are actually reporting record profits… The INR recorded suffered it’s worst fall in 16 years in November, plunging nearly 7 percent and hitting a record low, because of persistent dollar demand from importers and portfolio outflows due to global risk aversion (link). Who’s to say that it won’t drop even further? It may or may not but once thing’s for certain — the global uncertainty will not go away soon. In my opinion, diversifying currency risk by investing is US Dollars is essential during uncertain times, for HNI and small investors alike.

Another interesting, and probably counter-intuitive factor, is the strength in the rental markets here in America. Many people have lost their homes or simply walked away from them when values dropped. On top of that, lending standards have tightened up substantially – to the point of being absurd. As a result, home loans are hard to come by. However, all these people need places to live and to keep a roof over their heads! Consequently, the rental market is actually strong and getting stronger. What a unique time for investors with cash – low property values and good rents.

For these reasons, I believe this is actually an optimum time for foreigners to diversify in to USA real estate: prices are low, rents are strong, rent demand is rising, and the US$ will continue to be an important currency in this turmoil. I believe this is a low-risk situation that comes about only once-in-a-lifetime!

Rohit Prakash

President

American Full House, LLC.