Real USA House Prices & Price-to-Rent Ratio

Real House Prices and Price-to-Rent Ratio

Bill McBride on 6/26/2012 12:03:00 PM

Calculated Risk Blog

Nick Timiraos at the WSJ has a nice summary: Why Home Prices Are Rising Again (According to Case-Shiller). It wasn’t hard to see this coming: Home prices rose in April after a spring that bought more buyers chasing fewer homes.

Yes, this was pretty easy to see coming. A key question is: Did nominal house prices bottom in March or will there be further price declines? I think it is likely that prices have bottomed, although I expect prices to be choppy going forward – and I expect any nominal price increase over the next year or two to be small.

I’ve seen some forecasts of additional 20% price declines on the repeat sales indexes. Three words: Not. Gonna. Happen.

…

And here is another update a few graphs: Case-Shiller, CoreLogic and others report nominal house prices, and it is also useful to look at house prices in real terms (adjusted for inflation) and as a price-to-rent ratio…

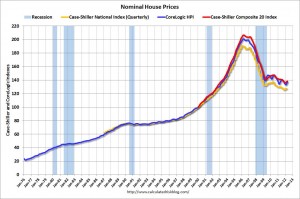

Nominal House Prices

The first graph shows the quarterly Case-Shiller National Index SA (through Q1 2012), and the monthly Case-Shiller Composite 20 SA and CoreLogic House Price Indexes (through April) in nominal terms as reported. In nominal terms, the Case-Shiller National index (SA) is back to Q4 2002 levels, and even with the recent increase, the Case-Shiller Composite 20 Index (SA) is back to March 2003 levels, and the CoreLogic index (NSA) is back to May 2003.

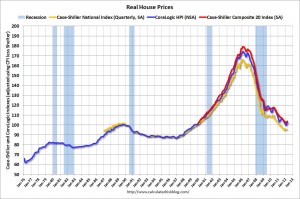

Real House Prices

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices. In real terms, the National index is back to Q4 1998 levels, the Composite 20 index is back to March 2000, and the CoreLogic index back to February 2000.

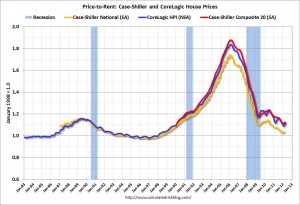

Price-to-Rent

On a price-to-rent basis, the Case-Shiller National index is back to Q4 1998 levels, the Composite 20 index is back to March 2000 levels, and the CoreLogic index is back to April 2000. In real terms – and as a price-to-rent ratio – prices are mostly back to late 1990s or early 2000 levels.